The U.S.-China trade war just got a lot worse. And there’s no quick fix for relations

The Trump administration’s abrupt Chinese tariff hike Friday raises strong doubts on whether the world’s two largest economies can reach a deal to quell their escalating trade war in the coming weeks.

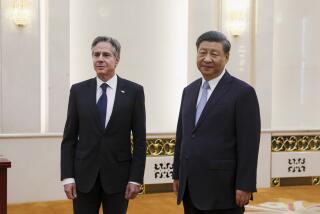

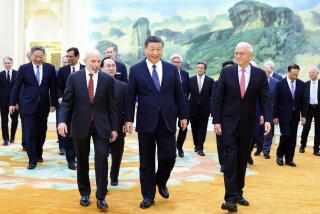

Senior U.S. and Chinese trade officials met over two days in Washington, but talks broke off Friday without signs that they were any closer to resolving their differences. President Trump tweeted that the discussions were “candid and constructive” and that his relationship with Chinese President Xi Jinping “remains a very strong one.”

Chinese Vice Premier Liu He told Chinese journalists before leaving Washington Friday that the two sides would meet again in Beijing for another round of talks, but there was no word on when it would take place.

Trump said Friday that he was in no hurry for a deal. “There is absolutely no need to rush,” he wrote in a Twitter message in which he praised the tariffs he’s already slapped on Chinese goods and touting how much more he can impose.

Even if the two sides can break through the stalemate and strike a deal on trade, the larger message of the week is that U.S.-China relations have changed fundamentally, and there is probably no going back.

Although their business relations are deeply entwined, the White House and China view themselves as aggressive rivals jostling for global influence and geopolitical power.

The trade war launched by Trump is just one manifestation of this. Military friction in the South China Sea, a string of espionage scandals, China’s rising military strength and the Trump administration’s battle against Chinese tech giant Huawei are all signs of an ominous chill in relations.

Although a trade deal seemed at hand in recent weeks, Trump administration officials have accused China of reneging on agreements that had been made over months of negotiations. To pressure Beijing to return to its previous commitments, Washington ratcheted up tariffs on $200 billion in products from China from 10% to 25%. China announced immediately that it would retaliate.

Some experts said last-minute revisions from China are typical of its negotiating strategy, as with Trump’s mercurial bargaining style.

If trade negotiators do not reach a deal in coming weeks, the U.S., Chinese and global economies will be hurt, say analysts, who assume both sides will find a way to end the impasse.

“My baseline scenario is that both leaders still need a deal for political reasons, so we are likely to get one in the next few weeks, but it won’t be this week,” said Arthur Kroeber of Gavekal Dragonomics, a financial research firm headquartered in Hong Kong. “The maneuvering right now is mainly end-of-negotiation stuff. But both sides are playing brinkmanship pretty hard so there is material risk (say 20 to 25%) that we don’t get a deal.”

But the prolonged trade war — and Friday’s tariff hike — serves as ammunition for hawks on both sides, who see a more confrontational struggle for global dominance unfolding.

In China, there is a growing belief that the U.S. motive in the talks is not to balance trade relations, but to undermine China, slow its rise and hamper its ability to best America in strategic high-tech fields.

Tariffs already have prompted some U.S. firms in China to shift their supply chains elsewhere. China hawks in the Trump administration believe that applying heavy taxes on imports can be one way to “decouple” from China.

U.S. legal charges against Huawei executive Meng Wanzhou, and Secretary of State Michael R. Pompeo’s blunt efforts to dissuade European nations from using Huawei in 5G telecom networks by threatening not to share intelligence, have hardened suspicions in China, as have harsh criticisms and rhetoric from other senior officials in the Trump administration.

“None of the news of the past year or two has been very positive in terms of the geopolitical direction of this relationship. It’s gone from tense to worse, and while the trade relationship seems to get a lot of the headlines, a lot more problematic, even dangerous elements are unfolding in other areas of the relationship particularly around security and military affairs,” said Bates Gill, China expert and professor at Macquarie University in Sydney, Australia.

“A so-called resolution of the current trade war is not going to remove or resolve the fundamental structural problems in the economic relationship,” he said.

U.S. business has long favored engagement with China, arguing that external pressure from the United States and others has pushed China to open its economy. More recently, however, that assumption has been called into question by many in the West, giving Trump more political space to go after China on trade and other areas.

Still, Jacob Parker, vice president of China Operations at the U.S.-China Business Council, warned that if the Trump administration confronts China too aggressively, it could backfire. He said that instead of persuading China to open up more to American companies and ending its insistence that they share their technology in return for market access, aggressive new tariffs could have the opposite effect.

Parker also warned that Friday’s tariff hike on $200 billion of Chinese imports — and Trump’s threats to slap tariffs on an additional $325 billion in Chinese goods in the near future — has undermined economic reformers in the Chinese system and strengthened the voices of hard-liners.

“That hardens those voices domestically and reinforces the perspective that the U.S. is trying to contain China,” he said. “If we push the Chinese too far, I think there’s a concern in the business community that we may go beyond what China can accept and that things could start to fall apart. If that happens, I think we can at the least expect that the Chinese economic reform process would come to an end.”

And in Washington, the lack of a deal would result in “increased tensions between the national security wing of the U.S. administration, who will be happy with this result, and the business-tech community, who are anxious to expand their participation in China and will be pretty mad,” said Kroeber, of the Hong Kong financial research firm.

Stephen K. Bannon, former chief strategist to Trump, is among a group of hawks who formed the Committee on the Present Danger: China, an organization that sees its role as warning Americans and political and business leaders of the “existential threats” to America posed by China.

Meanwhile, Hu Xijin, editor of the Communist Party-owned Global Times, has tweeted in English that China was “fully prepared for an escalated trade war.” He argued there is increased popular support in Beijing for a confrontational approach to the U.S.

“More and more Chinese now tend to believe the current US government is obsessed with comprehensively containing China,” he tweeted Thursday.

A Global Times editorial Thursday said trade was “only a sideshow” in the confrontation between the U.S. and China and the real issue was the U.S. fear that China would catch up to it in high-tech fields.

“The real intention of the U.S. is to squeeze China’s space in new technologies,” the editorial said.

Many analysts, including Australian professor Gill, share the view that relations are in long-term decline.

“Things will continue to slide downward into deeper competitive tensions,” Gill predicted, “including on the economic front because trade is not the problem. The deeper problem … is the question of economic and technological competition.

“Ultimately at the bottom of all of this, the problem abides that the two countries don’t trust each other and see each other as long-term strategic competitors.”

Steve Tsang, director of the SOAS China Institute at the University of London, said regardless of who is president, the U.S. and China will become increasingly competitive in the next two decades.

Chinese President “Xi Jinping is not a forgiving man, so I think we can see that Xi Jinping will take a more robust stance against the U.S. if and when he feels that the Chinese government is able to do so successfully,” Tsang said.

As relations decline, both Washington and Beijing are likely to compete to draw countries into their orbit, he predicted.

He said European countries and the U.K. would drift toward the U.S. “because ultimately this is what we believe in more. You will have a whole bunch of other countries that will drift towards the Chinese because they remain fundamentally authoritarian states.”

China’s global Belt and Road Initiative — in which it projects its international power through soft loans for infrastructure — would also draw some nations to China, he added.

Underscoring frictions are U.S. fears that China may overtake it in a range of high-tech fields including space exploration, artificial intelligence, surveillance technology, driverless cars and even military hardware.

Huawei’s emergence as the global leader in 5G technology — with no American rival — was a shock to U.S. policymakers.

Parker, of the U.S.-China Business Council, said that although the U.S. and China face a challenging security relationship, it is important to ensure that trade is not affected.

“I think there’s definitely a competitive dynamic between the U.S. and China, and that will continue into the future. The twist is to ensure that the national security issues don’t get entwined with the businesses’ side.”

The United States faces a possibility that in decades, China could overtake it as the world’s largest economy. China’s economy is already ranked No. 1 in terms of purchasing parity power, a measure that adjusts GDP to account for price differences in countries.

“It would be a major milestone. It would send a lot of shock waves and shivers certainly in the United States and much of the rest of the world and I think would be seen as a major turning point, not unlike the United States overtaking the United Kingdom as the world’s largest economy back in the late 19th century,” Gill said. “It would certainly be the end of an era and the beginning of a new one.”

Trump’s tariff hike on Chinese goods takes effect as the two sides keep talking »

Twitter: @RobynDixon_LAT

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.