CalPERS sank millions into National Enquirer? That’s a financial crime, not a political one

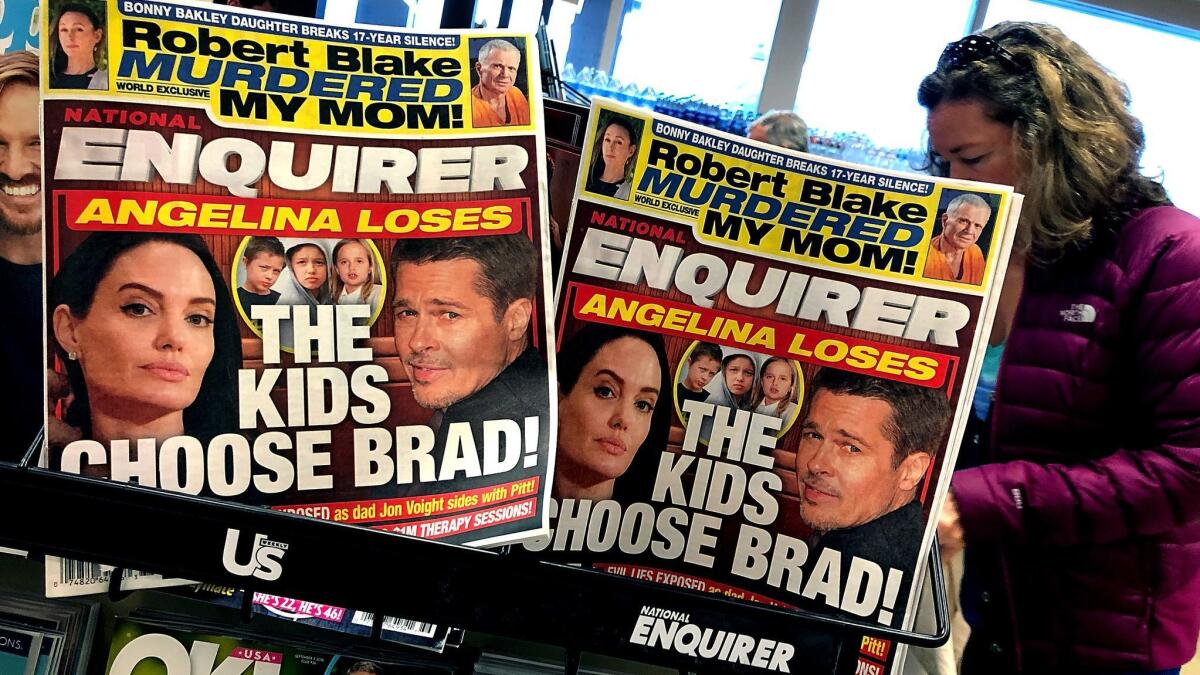

Many current and former public employees in California were no doubt rankled by my colleague Matt Pearce’s revelation that their pension dollars were sustaining President Trump’s favorite supermarket tabloid, the National Enquirer, during its hours of greatest need.

“During the 2016 presidential campaign, California’s massive public pension fund, CalPERS, was one of the biggest investors in the debt-laden owner of the National Enquirer, according to public records reviewed by the Los Angeles Times,” Pearce wrote.

For the record:

11:15 a.m. March 5, 2019This blogpost suggests that the Los Angeles Times revealed the connection between CalPERS pension investments and the National Enquirer’s parent company. In fact, the investment was first reported in the online site Maplight and was simultaneously published on two other sites: Fast Company and Capital & Main.

In fact, he calculated, the California Public Employee Retirement System appeared to own one-third of the tabloid’s parent company, American Media, through its $608-million investment in a hedge fund run by Chatham Asset Management.

Money being fungible, you’re free to argue that Chatham’s investment in American Media in 2014 found its way into the ink supplies used to print any number of Enquirer headlines, including “Hillary Clinton’s Two Secret Strokes” and “Doomsday if Hillary wins White House! WORLD WAR 3!”

Enter the Fray: First takes on the news of the minute »

But here’s the thing. Job No. 1 for CalPERS is to raise the money needed to pay the retirement benefits that it is being relied upon to pay. And it counts on solid returns every year (a little more than 7%, currently) to help build the fund to the level required — the contributions made by workers and employers (i.e., taxpayers) are not enough. Unfortunately, the fund has racked up shortfalls or even losses in too many years, so it seems perpetually to be playing catch-up.

That’s why it gets into bed, so to speak, with hedge funds and other investment first that are looking for returns, whether it be from a teetering publishing firm (which would have to offer better terms in exchange for a loan than, say, a healthy broadcaster) or from a defense contractor building planes for Saudi Arabia. (Relax, that one is just theoretical — I think.)

The real problem with the Chatham investment is the lousy returns, not the politics. The pension fund has earned only 2.3% a year from the Chatham fund since it made the investment in 2009. Had CalPERS put the money into a low-cost index fund that tracked the Dow, it would have made more than five times as much money.

Because CalPERS’ hedge-fund investments have cost more and returned less than hoped, CalPERS’ management decided in 2014 to gradually pull out of those funds entirely — a $4 billion withdrawal, all told. By 2018, Pearce reported, CalPERS’ stake in the Chatham fund backing American Media was down to about $200 million, on its way to $0.

In other words, CalPERS is letting results, not politics, steer its path on this bad bet.

It’s certainly possible for CalPERS to channel its investments solely into businesses and pursuits that are aligned with the social goals of the state, to the extent those can be defined. But the only sure way for CalPERS to avoid controversy while meeting its obligations would be for it to slash its expected rate of return to a far more modest level, which would allow it to give the performance of each investment a lower priority than the perceived virtue.

Doing so would come with a tradeoff that, it seems fair to predict, would be unacceptable to most workers and voters. CalPERS would have to demand considerably higher contributions from employees and taxpayers — or cut retirement benefits deeply for all new employees. Given the choice, most Californians would probably put up with CalPERS taking more financial risks like their investment in American Media.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.