Editorial: Editorial Board: The GOP’s big tax win is a loss for the rest of us

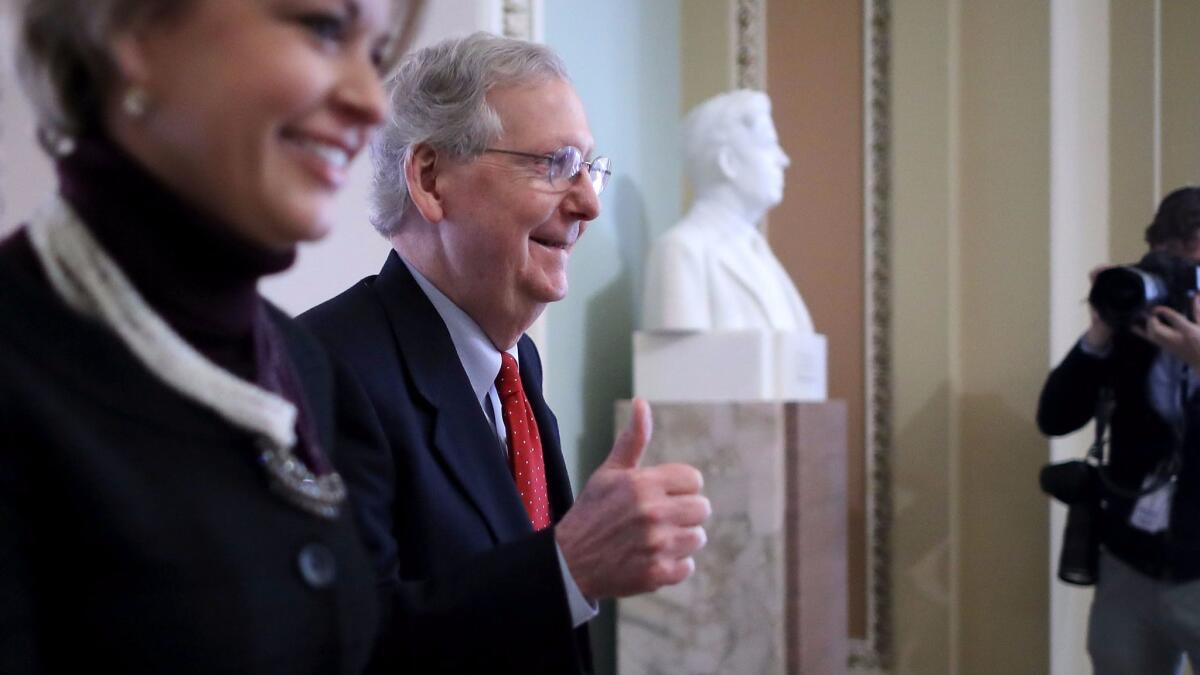

Congressional Republicans finally appear poised for a signal legislative achievement after months of near-misses and face-plants caused by intraparty squabbling. Now that the Senate has joined the House in passing versions of a bill to cut taxes — with the support of virtually all Republicans and no Democrats — there’s little doubt that the GOP majority will work out a measure that Republicans in both chambers can support, and send it to President Trump to be signed into law.

But the first big win for Republicans in Washington is a loss for the rest of us. Yes, there may be plenty of Americans who will see their tax bills go down, certainly at first. The biggest beneficiaries, though, will be businesses with the highest profits and individuals with the highest incomes, and some of the biggest losers could be those who can scarcely afford the higher tab — graduate students, for example. More broadly, the measure will cause either much larger deficits or large cuts to Medicare and other federal programs, quite possibly accompanied by higher interest rates for borrowers.

The Senate version also includes a booby trap for the state exchanges where millions of people buy healthcare insurance: an end to the Affordable Care Act’s requirement that adult Americans obtain coverage. That seems certain to drive premiums even higher and cause millions more Americans to go without insurance. That’s an incredibly reckless path to travel.

History tells us that even when tax cuts do boost growth, they never do so to the extent needed to compensate for the lost revenue.

There’s a good argument to be made for simplifying the tax code, winnowing the thicket of tax breaks and using the extra revenue to lower rates, as Congress did with the bipartisan Tax Reform Act of 1986. For one thing, doing so would help make the U.S. more competitive with the lower tax rates charged in the rest of the industrialized world.

But President Trump and many congressional Republicans weren’t satisfied with simply reforming the tax code. Instead, they’re rushing through a deep cut in rates, particularly for businesses, far beyond what could be offset by eliminating some deductions, exemptions and credits. With no hearings on its specifics, little debate and a raft of provisions aimed at winning individual lawmakers’ votes, the measure is bound to be a magnet for unintended consequences.

In addition to a dramatic cut in corporate tax rates, both the House and Senate bills would create a big new tax break for “pass through” businesses (like President Trump’s) — partnerships, small businesses and other entities that report their business profits on their individual returns. But the rationale the congressional leadership has offered for cutting corporate rates doesn’t apply to pass-throughs. Unlike corporate earnings, which are taxed twice on their way to an employee’s or investor’s bank account, pass-through earnings are taxed only once. In other words, they’re already treated favorably by the tax code, and would benefit as well from the GOP’s proposed cuts in individual tax rates.

Top administration officials argued that the tax cuts would pay for themselves through a surge in economic growth. The congressional Joint Committee on Taxation punctured that fantasy balloon a few days before the Senate vote, however, estimating that the growth spurred by the tax cuts would offset less than a third of their $1.4 trillion cost over the coming decade. That’s no surprise — history tells us that even when tax cuts do boost growth, they never do so to the extent needed to compensate for the lost revenue.

Besides, now that the economy has climbed out of the depths of the last recession, it no longer needs the sort of fiscal adrenaline that tax cuts can provide. The country is producing goods and services at a healthy clip, the total economic output recently reached its maximum capacity for the first time since 2007, unemployment is at its lowest level in the 21st century, corporate profits are rising rapidly, wages are climbing, and forecasters expect another solid quarter of growth to end the year.

It’s worth remembering how congressional Republicans blocked all of the stimulus proposals Democrats made after the recession ended even though the economy was still stuck in low gear. Back then, they believed that budget deficits were a horrible, awful, no good thing. Now, not so much.

Under federal budget law, however, Congress can’t just run a bigger deficit. If the tax cuts go into effect as proposed, they could trigger automatic, across-the-board cuts in a wide range of federal mandatory spending, including a 4% cut in Medicare. GOP leaders say they won’t let that happen; a more likely result is that Congress will agree to waive the across-the-board cuts and let the deficit grow. That would raise a different set of problems. More of the federal budget would be consumed by debt payments, and the ever-larger borrowing could push up interest rates for everyone. Ultimately, the next generation would be left to foot the bill for this Congress’ irresponsibility. That’s some victory for the GOP.

Follow the Opinion section on Twitter @latimesopinion and Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.