Bailout for teachers’ pensions to cost California school districts

California’s public school districts could face difficult cutbacks if state officials move forward with a plan to bail out the retirement fund for teachers, officials and educators say, but even those painful steps may fall short of curing the pension deficit if investments don’t meet expectations.

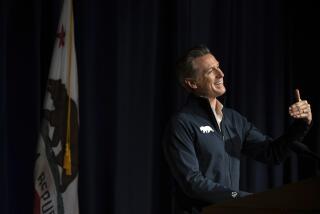

Under a proposal released last week by Gov. Jerry Brown, more money will flow into the California State Teachers’ Retirement System to begin closing an estimated $74-billion shortfall. But addressing that problem creates a different one: School systems would have to quickly pare back spending for next year, and they would face steeper diversions of dollars in later years.

“It has a lot of school districts reeling in terms of how to grapple with this unanticipated expense in the coming school year, throwing a major wrench into everything,” said Kevin Gordon, president of Capitol Advisors Group, a Sacramento company that lobbies on behalf of school districts.

California’s school systems still will see overall funding rise, but not as much as they’d been planning after several years of reductions. Under the governor’s plan, the pension contribution from school districts will rise next year to 9.5% of payroll from the current 8.25%This will increase to 19.1% over seven years. In other words, for a teacher who earned $50,000 a year, a district would have to set aside an additional $9,550 annually for that instructor’s retirement.

Paying that much to the pension program “could be devastating,” Perris Union High School District Supt. Jonathan Greenberg said.

To make matters worse, officials said, the highest contribution rate takes effect after the expiration of a temporary tax increase that is now boosting school revenues.

The pension transfer comes as the governor and the Legislature fundamentally change the way schools are funded. Beginning this year, school districts will receive additional money for students who are low-income, struggling to learn English or in foster care.

In Long Beach Unified, the pension transfer will consume about 8% of the funding increase it had budgeted, said Supt. Christopher J. Steinhauser. Long Beach had planned conservatively and the superintendent believes the system can absorb the loss without slashing programs or jobs based on the earlier, larger budget.

The situation and the politics are more complex in L.A. Unified, the nation’s second-largest school district. There, community groups and activists have mobilized to demand more money for all or some of the most disadvantaged students. Employee unions also are seeking significant raises and job restorations after the recession and declining enrollment led to layoffs and other cutbacks affecting services to students.

But with the pension proposal, L.A. Unified Supt. John Deasy is concerned that community groups and others will feel slighted and angry that money they expected may not come through.

“This is something I am very worried about,” Deasy said. “We’ve made commitments to the community. Everyone has a sense of: ‘We want more, not less.’ And now we have to decide what to cut. We will lose credibility.”

All districts would have to reduce their budgets before July 1, which is the start of the new budget year.

L.A. Unified would forfeit about 10% of its increased funding for next year. Some districts would surrender a much higher percentage.

“We are very concerned,” said Greenberg of the Perris district. Making the adjustments “in six weeks could put us in a difficult financial position.” However, “this governor has done so much for public education. I trust his judgment that this plan will have long-lasting benefits for public education.”

Brown acted on estimates that the teachers retirement system will run out of money in 30 years. The cost of benefits to retirees has far outpaced contributions to the fund and investment returns on pension holdings.

In January, Brown suggested waiting until next year to begin addressing the problem. John A. Pérez, then the Assembly speaker, pushed for earlier action. When Brown released his revised budget, it included a fix beginning this year.

“It costs us hundreds of millions of dollars for every year we wait” to increase deposits into the fund, Brown said. “We’ve been talking about it, and I believe it’s time for action.”

The teachers retirement agency supports the governor’s plans.

Pension contributions come from three places: the employee, the state and the local school district. Under the governor’s proposal, all would pay more.

Employee salaries would be least affected. Teachers now have 8% of their salary deducted for retirement. That figure would gradually rise to 10.2% over three years.

Deasy said the governor and the Legislature should postpone action for one more year. At that point, other funding should relieve more of what school systems would pay to preserve services for students, he said.

State Senate President Darrell Steinberg (D-Sacramento) said he was still reviewing the governor’s proposal but recognized that “a big hit” loomed for school districts.

“We have to be very careful with how we do this,” Steinberg said.

Brown is taking needed action, said Assemblyman Rob Bonta (D-Alameda), who chairs a legislative committee that has been holding hearings on the issue. “We have to take the leap together,” he said. “It’s absolutely necessary for the health of California’s budget, and necessary to fulfill our promises to our hardworking teachers.”

By some estimates, Brown’s solution is not aggressive enough.

The governor’s plan is based on projections of investment returns that are unrealistically optimistic, said David Crane, a lecturer in public policy at Stanford University. He also dislikes the gradual increase in contributions because it postpones too many payments into the future, when the economy and budget may be worse than today.

“Long term, it means the next generation will have less money to spend on services of benefit to them because they’ll have to use their taxes to pay off our debts,” Crane said.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.